Chapter 11:De-Risking rural EB-5: How the EVelution Energy Project Redefines Investor Confidence

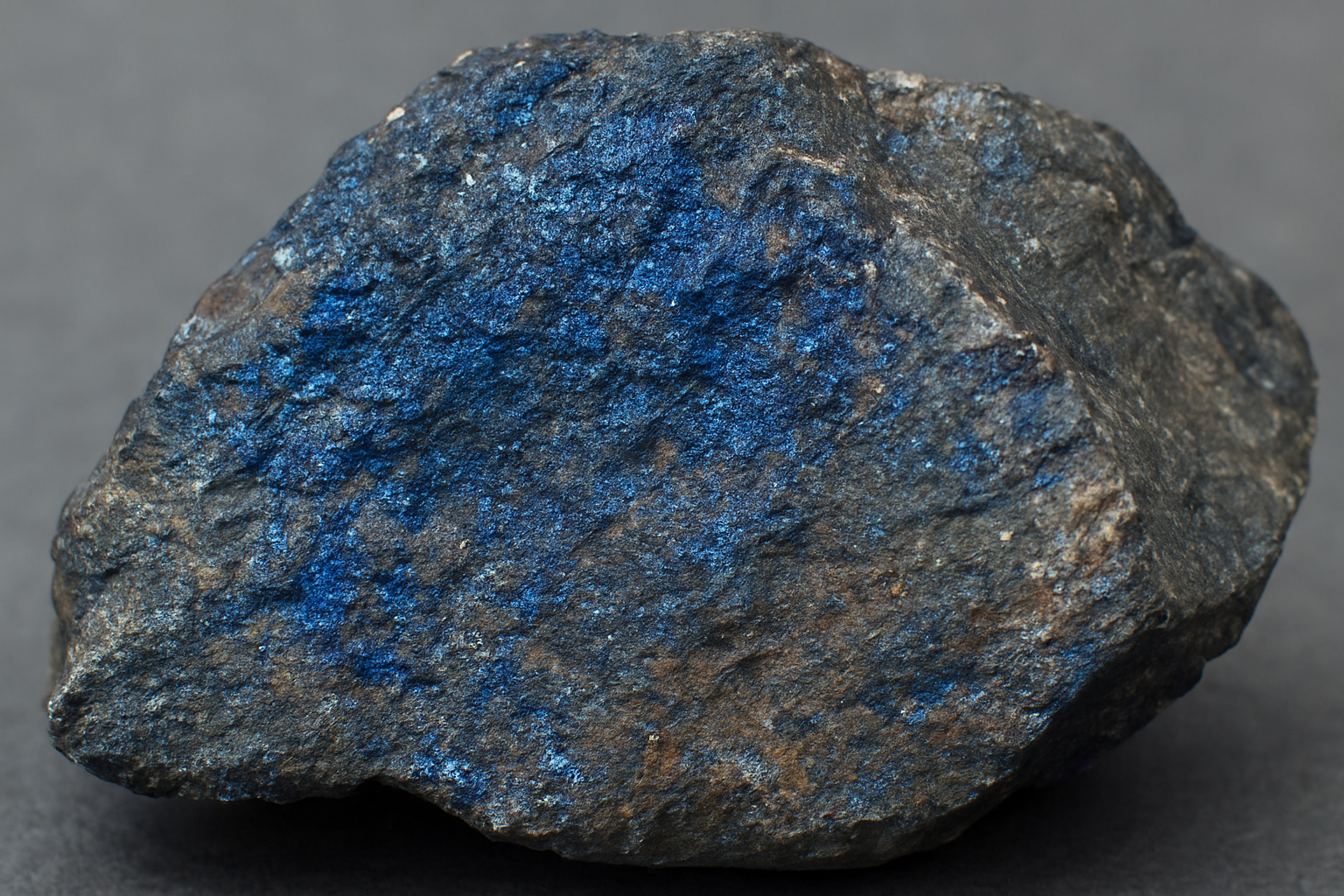

Marco Lopez shares why this Yuma County cobalt facility combines community backing, strong economics, and national interest to create a uniquely secure EB-5 opportunity.

In Chapter 11 of our interview series, Michael Gibson and Marco Lopez, Managing Partner at Intermestic Capital, explore the unique value proposition of EVelution Energy’s cobalt processing facility in Yuma County, Arizona.

While many rural EB-5 projects struggle with risk and financing, this one stands apart:

Economic safeguards: Input and output prices locked in through negotiated contracts.

Job creation: Over 3,300 jobs projected — far beyond EB-5 requirements.

Community support: Endorsed from U.S. Senators to the local Mayor.

National interest: Reshoring a critical industry for clean energy and national security.

As Marco explains, these elements transform what might be considered a “risky rural project” into a high-value, strategically important investment — and a model for EB-5 success.

Evelution Energy Interview Chapter 11

Michael Gibson, USAdvisors, interviews Marco Lopez, Managing Partner, Intermestic Capital

Transcript

Evelution Energy Interview Chapter 11 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

Dennis, I'm glad you mentioned the risk. And Marco, I want to ask you. So it's interesting because when the EB5 program pivoted a few years ago after the enactment of the RIA, the Reauthorization. It was interesting to me to see now, how we went from so many metro commercial real estate projects. Large developments, New York City, LA, Miami. We must have had three dozen projects going on at this, at the time. To now seeing a shift much more to the rural. Because of the processing times and the priority that's given to them. But my concern is as an investment advisor, I see a lot of these rural projects, and I see a huge amount of risk. I and, and I for, it's for a good reason, that they have a hard time obtaining the capital. Because of the, the just the, the risk profile of the enterprise. You may have these resorts we've, we've seen experience with past EB5 projects, who were located in rural locations and had a disastrous result. But it was so enlightening to hear from the principles of the EV cobalt processing plant. How they have the profit margins. And how they have locked in the sale that, you know not only their input price, but they're at output. So, Marco, tell us, for the viewers who may not be as familiar with the with the risk profile or with the monetary outlook for this. What is it interesting for you? What is attractive about this project from an investor standpoint?

Marco Lopez, speaking

Well, when we started our conversation, I talked about being someone born and raised on the border. And Yuma County is one of our county, our border counties with Mexico. And so that to me was an appealing factor because you're bringing a community a great value. I think Gil talked about from an energy perspective, from a water perspective, from a job safety and security perspective, And the right, the reason why the community embraces this project. All the way from our US Senators down to the Mayor. Because they understand the value and the importance that you're bringing from an economic development standpoint. And so the task in our EB 5 work is, are you going to fulfill and meet the job demand that the project requires.

Michael Gibson, speaking

Outlined in the Business Plan.

Marco Lopez, speaking

Right. So are you going to be able to match 10 per investor? And here unequivocally, the answer is absolutely. Are you going to be able to provide the economic viability of the project? And here, again, because of the safeguards that Gil and Navaid, and the team have a negotiated, and already contracted, the answer is unequivocally absolutely. And so, that was part of the selection criteria for our firm. Is, if we were going to pursue this opportunity? And, and what was the most appealing, I think, Dennis mentioned, and you mentioned it. Arizona is full of developers in shopping centers, housing, you name it. You can't toss a cat and not hit a real estate agent or a commercial real estate agent.

Michael Gibson, speaking

Yes.

Marco Lopez, speaking

And so that's not appealing or exciting. We would have rejected, and we’ve rejected those types of offerings, here because there's nothing unique here. You add the layer of the national interest, the opportunity to bring and re-home an industry that's vital for national defense and national security to America. And then all the pieces start lining up. And that risk becomes de-risked.

Michael Gibson, speaking

Yeah, and, and what, what fascinates me about Intermesic is that, I mean, even though this is your first EB 5 project, you, you are a capital firm. You, you focus on risk, you focus on how does the investor do well in, in investing in other projects that you may be associated with. So you, from what I understand, you’re taking the same philosophy, of trying to find projects that make good sense economically. And now you’re bringing it to an EB5 component. So we have the job creation component. But then in addition, you want to make sure that the project makes sense economically.

Marco Lopez, speaking

That’s right. So look, in this particular case we know that the job, that the project is going to create over 3300 jobs. And we’re not, we’re not going to need all those jobs. To just…